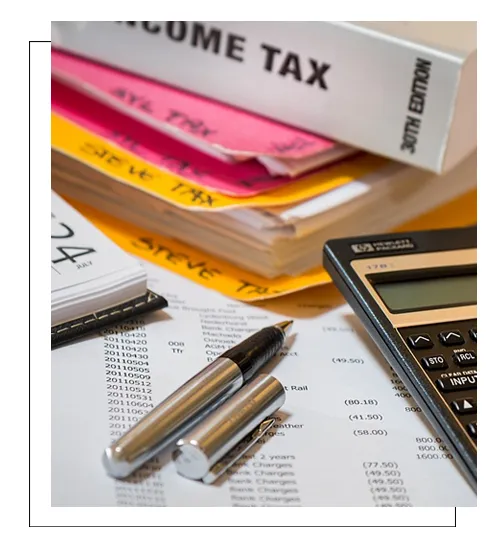

As per the Income Tax Act, it is mandatory to file ITR if:

Income tax returns need to be filed before the due date, else penalties are applicable.

| Category of Taxpayer | Due Date |

|---|---|

| Individuals / HUFs / Firms (non-audit cases) | 15th September |

| Businesses / Professionals requiring audit | 31st October 2025 |

| Companies / Working Partners in audited firms | 31st October 2025 |

| Due Date for Filing Tax Audit Report | 30th September 2025 |

| Total Income | ITR Filed After Due Date | Late Fee Payable |

|---|---|---|

| Up to ₹2.5 lakh | No penalty | ₹0 |

| Between ₹2.5 lakh – ₹5 lakh | After due date | ₹1,000 |

| Above ₹5 lakh | After due date | ₹5,000 |

| PACKAGE TITLE | PRICE | |

|---|---|---|

| Salary Package for Income < 50 Lakh, Rental Income, Interest and Dividend Income |

₹ 1,000 | Book Now |

| Salary - Complex Package for Income > 50 Lakh, Multiple Employer, Rental Income, Interest and Dividend Income |

₹ 1,500 | Book Now |

| Salary - Premium Package for Income > 50 Lakh, ESOP, RSU, Multiple Employer, Rental Income, Interest and Dividend Income |

₹ 3,500 | Book Now |

| Freelancer/Consultant Package is for Consultants/Freelancers Income < 50 Lakh |

₹ 3,500 | Book Now |

| Professionals Package is for Professional Income < 50 Lakh |

₹ 3,500 | Book Now |

| Business Income (Small Business) Package is for Business Turnover < Rs 20 Lakh |

₹ 3,500 | Book Now |

| Business Income - Complex Package is for Business Turnover > Rs 20 Lakh and do not required Tax Audit |

₹ 5,000 | Book Now |

| Share Trading & F&O Package includes Salary packages and Income/Loss for Share Trading & F&O, do not required the Tax Audit |

₹ 3,500 | Book Now |

| Salary and Capital Gain Package includes salary packages and capital gain/loss |

₹ 3,500 | Book Now |

| Housewives/Other Small Income | ₹ 750 | Book Now |

| NRI | Starting ₹ 5,000 | Enquire Now |

There are various FORMS: ITR-1, ITR-2, ITR-3, ITR-4, ITR-5, ITR-6, and ITR-7 that are available online. These online forms vary depending on the criteria of the source of income and category of the assessee (as per section 2(7) of the Income Tax Act, 1961 it means a person by whom any tax or any other sum of money is payable under this act. But generally it is any person against whom proceedings under income tax act are going on, irrespective of the fact whether any tax or other amount is payable by him or not) It is the Income Tax Act 1961 and income tax rules 1962 which obligates a citizen to fill returns with income tax department at the end of every financial year (1st April – 31st March). Merakhata.com is the best reliable source for ITR filing online, quickest and most accurate way possible. Set-up a meeting with us by registering online at our website.

Accurate and

Timely Reporting

Professional

Consultancy

Partner in

your growth

Monthly

MIS reporting